We offer an Alt Doc Second Mortgage Loan Program

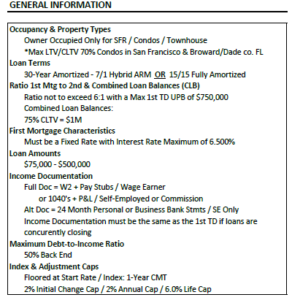

Also know as a bank statement only loan. We do not require Tax returns for self employed persons. But if you are a wage earner, that is you work for someone else, we require full doc.

This is a loan that goes behind a first trust deed. That fist Trust deed loan must be at a rate below 5%. Credit fico requirements for our “2nd” second home loans are stated below. Usually the cumulative loan to value CLTV can not be more than 75%. Our 2nd Trust Deed loans can be used for residential condos and 1-4 unit properties that are owner occupied. We specialize in easy-doc-or-alt-doc-second-mortgage-loans-stated-income.

Our Alt doc second mortgage or “loan” is very popular for self employed persons. They use this loan to assist in capital for their business.

Second Mortgage Rate Sheet & Matrix:

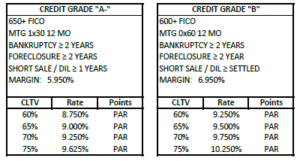

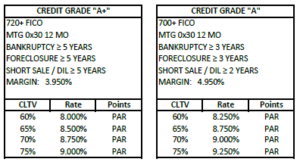

- Up to 75% CLTV

- Down to 600 Fico

- No Seasoning on Short Sales

- One Year Seasoning for Foreclosure’s & BK’s

- 50% DTI

- 30 Year Amortization 7/1 Hybrid Arm

- 15 Year Fixed

- No Balloons

- Up to $1 million Combined Loan Balance

- You income qualification – You choose full doc or 24 months months bank statements

Rates and LTVs

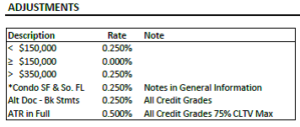

Calculate the final rate and fee

Descr. __rate_|_ fee_ | _Note_

Base Rate ______| ______| Fee Descr.

Adds ________|______| _______

________|______| _______

________|______| _______

________|______| _______

________|______| _______

Final Rate ______|_______| _Final Cost

Fees: Underwriting & Processing $1,695

Base Fee on All Loans;

2.75% for all loans. Loans outside of of CA have an additional fee of $1500

Total fees are capped at 3% of the loan amount.

Brokers may charge half of one percent as long as total fees do not exceed 3%.

Electronic Privacy Notice: Any rates and terms stated above are for professional real estate mortgage brokers and bankers only. Rates, terms and procedures subject to change daily.